Caribbean Capital Group, LLC is proud to present this unique offering featuring one of Belize’s premium, world-class products: cacao!

Be a part of this Offshore Investment Opportunity!

HOSTED BY DAVID KAFKA OF CARIBBEAN CAPITAL GROUP

Joining David is FINCA’s Managing Director, David Santilli

Watch this Webinar Replay to learn more about this investment opportunity!

This is a 506(c) offering open to accredited investors only.

Investment Minimum: $30,000

Project Returns: 9% to 11%

About this investment

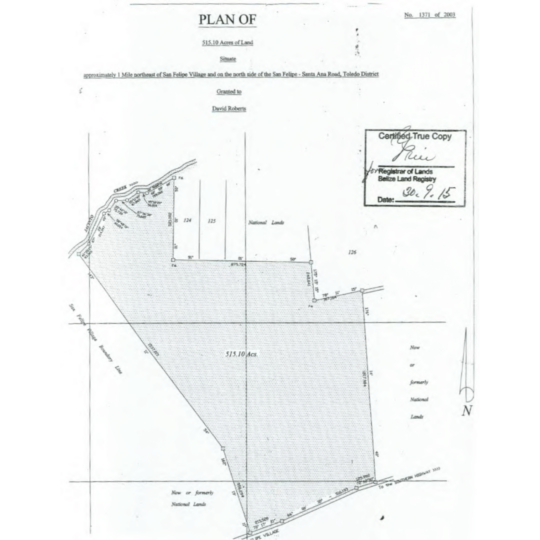

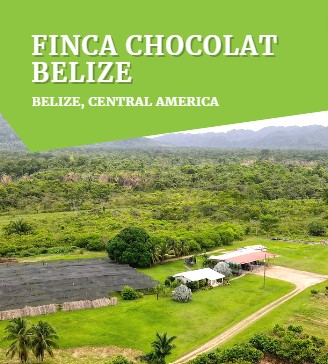

Finca Chocolat Belize is a 515-acre cacao and timber farm on Barranco Road in the Toledo district in Belize. The cacao trees are planted on a 10’ x 12’ grid resulting in 400 trees per acre, with 85,000 trees currently in cultivation.

We have partnered with a successful chocolate farm owner, David Santilli, to offer shares in our existing 515-acre cacao farm mixed with Salm wood, lemon grass, vanilla, and other income-producing plants and agriculture and sell these parcels for cash flow to investors.

We’re confident that this agribusiness investment will deliver a powerful combination of attractive yearly cash flow and long-term appreciation, culminating in high returns.

Investment Highlights

- Well established farm

- Currency producing

- Legacy investment

- Agriculture

- Passive investment

This may be the right investment if you’re looking to…

- Help reforest the earth one tree at a time

- Invest offshore for diversity

- Have a sustainable investment

- Have Cacao as a superfood

- Have a legacy investment

- Conservatively underwrite

- Hold a passive investment

What makes Belize attractive to foreign investors?

Belize is the only predominantly English-speaking country in Central America

- Offers a larger skilled labor force than its Central American neighbors

- Its currency is linked to the American dollar

- Affordable real estate with high demands and high appreciation rates

- Property laws apply to both Belizeans and foreigners equally

- No capital gains tax

- Low property tax

The growing demand in the global market

The global cocoa and chocolate market is projected to grow from $48.29 billion in 2022 to $67.88 billion by 2029, at a CAGR of 4.98% in the forecast period. Read More Here.

Belize: the world’s true cradle of chocolate

The BBC has reports on the history of Belizean cacao and has deemed it the “world’s true cradle of chocolate”. Cacao – the principal ingredient for chocolate – was both consumed and used as currency by ancient Maya royalty and political elites throughout the historical region of Mesoamerica, which included southern North America and most of Central America. Archaeological evidence points to Belize as the earliest hub of cacao cultivation, where Maya were drinking cacao beverages as far back as 600 BCE.

Our investment objectives

Caribbean Capital Group’s objective is to provide a profit to our investors while we manage and produce the highest quality cacao.

We intend to harvest, dry and deliver a superb product to sell to the marketplace. As well as harvest a high-quality hardwood tree called salmwood.

We aim to provide investors with a profit participating as we sell the lots to investors and a finished cacao to companies to make chocolate bars.

This is a 506(c) offering open to accredited investors only.

Watch this Webinar Replay to learn more about this investment opportunity!

This is a 506(c) offering open to accredited investors only.