Why is everything more expensive than ever before? It’s not an exaggeration. It’s inflation.

We’re seeing it here in Belize as well. $1 BZD or more for bread, gas is over $13 BZD a gallon, Dollar wings is now $1.50 wings. It’s all going up… but why?

What is Inflation?

‘Inflation’ is the gradual decrease in your money’s purchasing power which is reflected by a general increase in the prices of goods and services. Simply put, when prices go up then your dollar can’t stretch as far as it used to and you have to buy less. However, inflation isn’t always a bad thing.

Rising prices are a natural occurrence and can be managed when wages are increased to match the cost of living and government measures are applied to keep the economy running smoothly. But in the context

How the Pandemic Drove All-Time High Inflation

In response to the pandemic, the federal government has spent trillions of dollars to boost the economy which has greatly contributed to the all-time high national debt of $30 trillion. Debt to gross domestic product (GDP) ratio is estimated to have reached nearly 140 percent at the end of 2021.

You just might be thinking: “Ok, David. The economy is bleeding, inflation is happening, and so much is out of my control. What can I do about it?” My short answer is to diversify your financial portfolio (as I’ve said many times if you’ve been following me) but do read on and hopefully, you can take the advice and tips I’m sharing to get through these tough times and whatever might follow in the future.

To better understand how we can protect our assets, let’s start by putting inflation into perspective through the concept of time. Pay attention: it directly affects your nest egg.

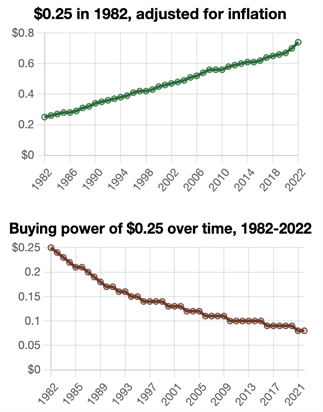

Interestingly enough, the last time inflation rose this fast was exactly 40 years ago in 1982 at 6.16 percent. Let’s keep it simple and look at how much the value of a quarter fares back then and now.

$0.25 had the purchasing power of about $0.74 today, which is an increase of $0.49 over 40 years. This means that today’s prices are 2.94 times higher than average prices in 1982, according to the Bureau of Labor Statistics consumer price index.

A dollar today only buys 33.784% of what it could buy back then. In other words, a dollar will pay for fewer items at the store. This means that today’s prices are nearly 3 times higher than average prices 40 years ago.

How Much Will Your Money Be Worth in 10 or 20 Years?

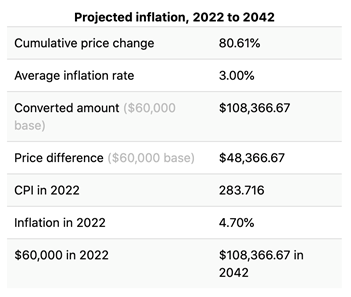

If you needed $60,000 for your first year of retirement, in 20 years you would require $108,366.67 to match today’s purchasing power of $60,000. This is assuming that the average annual inflation is at 3 percent. That initial $60,000 would be worth only $33,220.55 in 20 years.

You also need to factor inflation into your retirement as the cost of everyday items, travel, and other expenses will continue to rise. This makes retirees who are living off their savings especially vulnerable to high inflation.

Which brings me to my first piece of advice:

Protect Your Nest Egg: Assess your investment strategy and retirement income plan and see if you’re protected against inflation for the long term.

Sourcing your retirement fund entirely from fiat money —or a government-issued currency, like the U.S. dollar, that isn’t backed by a commodity such as gold or silver — makes it much more sensitive to inflation.

But there is an upside to inflation too. Everyone is seeing increased equity in their property— which will only increase with time. Find out how to unlock that equity to buy a property here in Belize.

In my next newsletter, I’ll explain why real assets are crucial to protecting your current and future wealth. In the meantime, if you have questions, feel free to schedule a call.